|

| Venture Capital Firms in Singapore |

Getting financial support from a venture capital firm in

Singapore is your biggest dream today as the city-state is, currently, the

leading destination for venture capital financing in Southeast Asia. Great! But, while chasing the investors, there are chances that you

might end up neglecting the factors that can drive them away from you. As an

entrepreneur planning to raise capital, it is your biggest responsibility to ensure

that you do everything the right way so that when the time comes to convince an

investor, you don’t have to struggle much and things go smoothly.

The VC industry in Singapore is still in its nascent stage,

so any venture capital firm in Singapore would like to pour their dollars in startups

that have proved their perfection in every aspect. Right from your first

approach to your ultimate reaction on the rejection or acceptance of the

investors, everything will come under the scanner. So are ready?

Here’s a list of factors that can disappoint an investor.

A Cold-call

You’ll simply invite a disaster by making a cold-call.

Simply sending your business plan to the investors including VC firms and angels

will do no good. It is only through a reliable recommendation that you can grab

their attention.

You Haven’t Proved

Your Startup Potential

You are saying you have a great idea but where’s the proof? Have

you tested your products or services on a set of beta customers? You have to have

a strong value proposition to show the investors how sizable and scalable the

market is. Unless you prove it, forget about the capital.

Your Idea Is Not

Unique

If you approach a renowned venture capital firm in Singapore

with a product or service which is already there in the market; in other words,

something which is not in demand, the investors will move back. You have to

think of a unique business plan so that you can tell the investors where you

see your startup in the next 5 years.

You Have A Poor Marketing

Strategy

A great marketing strategy always drives demand for a

product/service. If you fail to build a strategy strong enough to attract

customers, then how will you convince the investors? You are ready to sell your

product but if you don’t have a prior plan for boosting the sales and gaining a

competitive advantage over your rivals, you have to stumble at every step. In

such a scenario, it is impossible to gain the trust of an investor.

Your Team Lacks

Efficiency And Doesn’t Believe In Teamwork

What comes next to a unique business idea is a highly

talented, smart and efficient management team your company. The investors,

typically, invest in people and not the product or service, co they want to

ensure that the team they are investing in is creditable. Now if you have a

team which is not just inefficient but also doesn’t believe in teamwork, you

are nowhere.

You Are Not In Front

Of The Right Investor

This is a very common mistake that the first-time

entrepreneurs like you often do. So long you are knocking the wrong door, you

won’t get access to the capital you need, as simple as that. The investor will

either not respond or tell you straight on your face that you are in the wrong

place.

You cannot Handle

Rejection

If you are an entrepreneur, you have to learn to take things

sportingly. Handling rejections is an art and not everyone can do this so

calmly. But you have to and if you cannot, they won’t take time to say

Good-Bye.

You Are Not Being

Honest

Investing in a startup is a matter of great risk so if you

are inviting someone to invest in your startup, you have to be very honest in

your dealings. Do not keep things from your investors, at least, those things

that can, directly or indirectly, have an impact on the investment. If they get

to know about your dishonesty, it’s over.

Conclusion

So these are some of the points that you must have to take

care of while approaching a venture capital firm in Singapore. For more

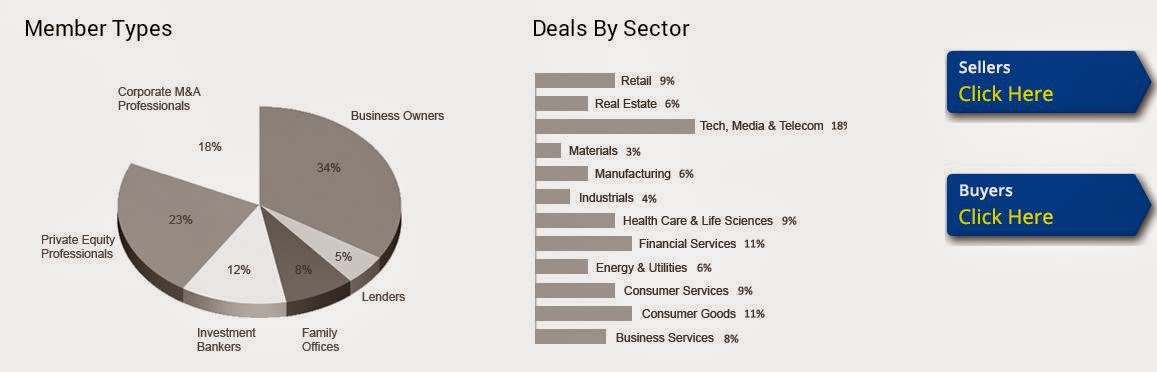

information, you can consider becoming a part of an intelligent network like

Merger Alpha that will take you one step closer to the right investors. Do

visit Merger Alpha at http://www.mergeralpha.com/.

You can also leave your queries in the comment box given

below.