|

| Venture Capital in Singapore |

Today, Singapore is the fastest growing VC hub of Southeast

Asia with investors and entrepreneurs from around the world getting

increasingly attracted towards this emerging Silicon Valley of Asia. Both

government and non-government VC firms are together working to boost the

startup ecosystem in Singapore.

Ever since the establishment of the TIF, Technopreneurship

Investment Fund, the venture capital industry in Singapore has started

witnessing a rapid growth. The past few years have seen the entry and formation

of numerous venture capital firms that have opened a whole new world for

startups looking for venture capital in Singapore.

The government of Singapore is extremely enthusiastic in pushing

the startup ecosystem for which it has already launched various initiatives to attract

more and more investors. To make Singapore a startup-friendly nation, the

government has launched several initiatives such as Equity Financing Schemes, Cash

Grants, Business Incubation schemes, Debt Financing Schemes and Tax Incentive

Scheme so as to enable the entrepreneurs to get easy access venture capital in

Singapore.

The private venture capital firms in Singapore are also working

in full swing to support the entrepreneurs looking to start a business in the city-state.

Some of the top venture capital firms in Singapore include JFDI. Asia, Golden

gate Ventures, Innov8 Ventures, Ardent Capital, Extreme Ventures and others.

These are constantly in search for unique business ideas where see a huge

market potential and an efficient management team.

Apart from offering venture capital in Singapore, the VCs

also offer guidance and mentorship to the startups. This is an added benefit

for the first-time entrepreneurs as they are comparatively new to the industry and

have less experience in building business strategies. The investors share their

experience, knowledge and valuable contacts with the entrepreneurs and give

them ample scope to grow and expand their businesses.

The private venture capital in Singapore mostly goes for the

service, manufacturing and the technology sector. Although the VC firms typically tend to invest

in the late-stage startups leaving the seed stage for the angel investors, they

still sometimes invest at an early stage if they find the investment extremely

profitable. They prefer those ventures which have the potential to grow into a

million-dollar business in future.

Entrepreneurs often find it highly challenging to get access

to venture capital in Singapore although, with all the requirements fulfilled,

they can definitely hope to find the right investor for their company. The

total duration of the investment is nearly 3 to 6 years and during this period

the VCs expect a return of 25 to 30 percent for each year’s investment. Once

the business reaches its peak, they take their share of profit and exit the

venture.

The best way to find venture capital is to do a proper

valuation of the business, sealing the loopholes, targeting a sizable and

scalable market and having an organized management team that can work

independently even if the owner is replaced. Do you think you have a sound business plan? Are you looking

for venture capital in Singapore? Do share your thoughts with us at the comment

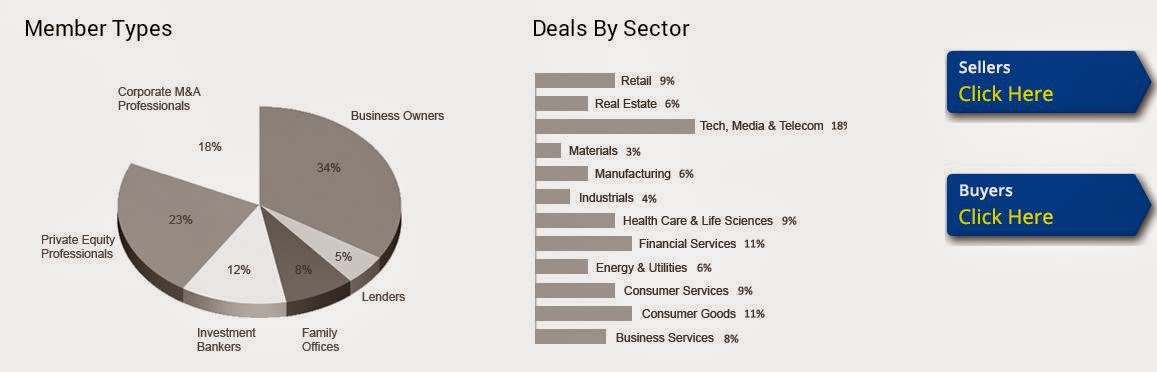

box. To get quick access to the right investment partner, you can also become a

part of Merger Alpha, a common platform targeted to bring together buyers,

seller, investors and financial advisors.

For more information on venture capital in Singapore, feel

free to visit http://mergeralpha.com/.